Celldex (CLDX) — CDX-0159 – The Mast Cell Warrior (New Recommendation)

BIOINVEST NEW RECOMMENDATION – Celldex (CLDX) We are initiating coverage of Celldex Therapeutics (CLDX, $12) with a BUY under $15 and a $30 TARGET PRICE. In our view, CDX-0159, the Company’s anti-C-KIT antibody has blockbuster potential in various mast cell diseases. With a market cap of ~$375 million with ~$200 million in cash, in our view, CLDX is extremely undervalued based on the potential of CDX—0159 alone. (…more)

TAU – The Next Target For Neurology Focus On IONS and SGMO

TAU – The Next Target For Neurology Focus On IONS and SGMO. Two neurology scientific meetings have taken place this Fall and focused on hot new targets for neurological drug development – notably, beta-amyloid and tau.

ESPR – Esperion Hits a Grand Slam With Triple Therapy Data

ESPR continues to execute at a Big Pharma/Bio level with a small, emerging Company focus. After the successful trial, the Company raised $150 million at $49 per share. NDA Filing And Enrollment Ahead of Schedule.

MDCO: ORION – Inclisiran Rising In The PCSK9 Sky

The Medicines Company (MDCO) presented the details of the ORION-1 Phase II trial interim results of 501 patients given MDCO-PCSK-9si at a Late-Breaker Session at the AHA. MDCO presented the details of the ORION-1 Phase II trial interim results of 501 patients given MDCO-PCSK-9si at a Late-Breaker Session at the AHA.

A Brief Look At Shorts

A Brief Look At Shorts (ACAD, ANTH, BMRN, INCY, IONS, MDCO, NVAX, NKTR, PCRX, ZIOP (for subscribers only).

SENTIMENT – A CORE MTSL INVESTMENT METHODOLOGY

February 19, 2015 The most recent reading of the CNN/Money Fear and Greed Indicator has entered the “Extreme Greed” range. While very short-term in nature, it represents the level of expectations investors have in stocks and today that level is quite high. It all suggests that while stocks may still move higher, they are likely to[…]

The Comparables

During the past year or so, biotech experienced an unprecedented number of companies going public. Over that period, we have added two such names to our portfolio – PCRX (2012) and FPRX (2014). A handful of these stocks have achieved remarkable valuations…

Biotech Fund Managers – What The Pros Do Every Year

August 21, 2014 The Medical Technology Stock Letter (“MTSLâ€) prides itself on identifying exciting small companies that will become leaders in their respective fields over time. We emphasize “over time†because that is the nature of drug development and compounded returns of successful biotech stocks over the years vastly exceed that of the overall market. […]

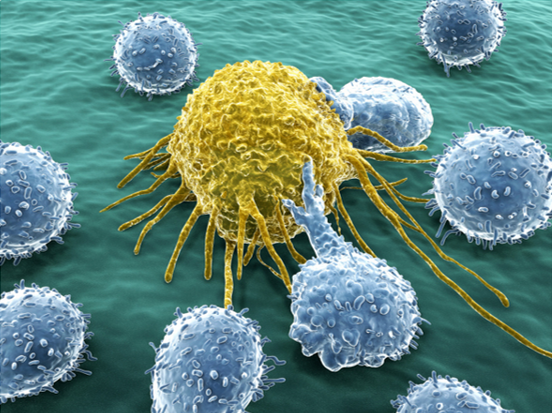

A BRIEF IMMUNE-ONCOLOGY UPDATE

June 12, 2014 ASCO 2014 – Immune Oncology Rises to the Top – As many expected, immune oncology (I-O) was all the rage at the recently concluded American Society of Clinical Oncology (ASCO) meeting. While it is widely acknowledged that before ASCO, Bristol was the leader in the space followed by Merck, and Roche. At[…]

NOT YOUR FATHER’S PLATFORMS

MTSL published Issue #753 “Plentiful Platforms†on April 25, 2012. Most of our platform recommendations have made significant progress since then, and our subscriber base has grown substantially as well.

Bios Go From 1st To Worst, Is A Bottom Near? New Recommendation

Five Prime Therapeutics’ (FPRX) Protein Platform Technology Ready For Prime Time – Five Prime is a classic early-stage platform company with, in our view, a proprietary and powerful technology based on management’s broad experience and unique understanding of proteins.

Graduation Day – the New Tiers: ISIS makes it to 1st Tier, NVAX & SGMO Join Tier 2

SuperBios: Amgen, Biogen, Celgene & Gliead – These four companies (a.k.a. The Four Horsemen) have emerged as the leaders of the biotechnology sector and have become true global players that, due to their size and innovation, can compete evenly with the Big Phama companies on the traditional pharmaceutical fronts.

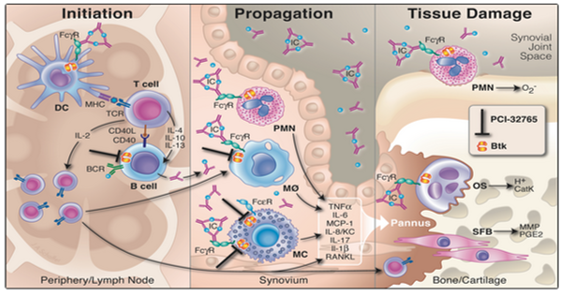

PCYC – Introducing The Autoimmune Program, The Next Chapter

PCYC – Understanding The New CLL Label & Introducing The Autoimmune Program – Raising BUY LIMIT and TARGET PRICE

INCY & ISIS – THE NEXT PHASE

CHASING INCY – INCY Poised to Emerge as Oncology Powerhouse, Raising BUY LIMIT – The biggest driver of INCY’s value over the last year, and in our view, going forward has been the emergence of their oncology pipeline.

2013 MTSL Portfolio Review – We’re #1!

According to the Hulbert Financial Digest (HFD), the Trader’s Portfolio of the Medical Technology Stock Letter was the #1 performing Portfolio of 2013 – with a return of 215%. This was out of more than 500 portfolios tracked by Hulbert.

INCY’s IDO and A Visit to Novavax

INCY’s IDO & Cancer Immunotherapy – Treating cancer with immunotherapy has become one of the major “Hot New Classes†over the last year as the science, compounds and subsequent studies have demonstrated the ability to significantly extend the lives of cancer patients.

WHAT BIOINVEST CAN DO FOR YOU

What can BioInvest do for you? BioInvest focuses on the most important topics, trends and therapies affecting the biotech sector and the MTSL portfolio. Learn more about and subscribe to our Medical Technology Stock Letter today.

ORAL ARGUMENTS

Historically, classic biotech companies developed monoclonal antibodies and proteins as new therapies for hard-to-treat conditions. There have been multiple examples of blockbuster successes (e.g., EPO, anti-TNF antibodies, HGH, human insulin, etc.) leading the past 30+ years to create the Biotechnology sector.

THE NEW CLASSES ARE IN SESSION

The pharmaceutical and biotechnology industries have gone through periods of blockbuster drug classes, which has often resulted in one or more leading drugs catapulting the respective company’s growth rates and, in many cases, market capital, to the very top of the industry.

HIT ‘EM WHERE THEY AIN’T

Unlike most Wall Street analysts, we find no need to continue to raise limits/target prices just because a stock has done what we expect it to. Our initial recommendations are based on the stocks not yet discounting what we believe are improving and/or undervalued fundamentals.

INCY KNOWS JAKS

INCY – KNOWS JAKS– RAISING BUY LIMIT & TARGET – INCB039110 Shows Promise with Proof-of-Concept Data in Both Psoriasis & RA, MF Next Up at ASH

The Music Never Stops

THE MUSIC NEVER STOPS We have compiled a reasonably comprehensive table summarizing, in detail, the key clinical and regulatory events of the entire MTSL Portfolio for the remainder of 2013. As noted above, multiple company events are approaching – several of which are important value drivers and, as such, MTSL continues to keep subscribers abreast[…]

MDCO – To Bleed Or Not To Bleed, They Answer The Question

The Medicines Company (MDCO â $30.92) â To Bleed Or Not Bleed, They Answer The Question New Recommendation â MDCO â The Medicines Company (MDCO) is a new recommendation at MTSL with a BUY UNDER 35 with TARGET PRICE of 50. Focused on acute care medicine in the hospital setting, MDCO markets three proprietary drugs, has[…]

A Brief Look At Shorts

August 10, 2013 A Brief Look At Shorts Short Interest Analysis of the MTSL With the vast majority of public companies still in the development stage and therefore rely on a single lead compound for success or failure, short selling is common in biotech stocks. Short selling is the selling of a security that the[…]

Novavax vs. Medicago

Novavax vs. Medicago NVAX â Further Dive On Medicago Acquisition Emphasizes How Undervalued Novavax Is â REITERATE BUY On July 12, Medicago (MDG) announced intentions to be acquired by Japanâs Mitsubishi Tanabe Pharmaceuticals (MTP), valuing the company at $376 million (including the assumption of $32 million of net debt). Comparing this price with the Novavax[…]

DRINK THE NEKTAR

DRINK THE NEKTAR NEKTAR NKTR â H2 Filled With Events Across Deep Pipeline, Focus â181 Data And Then Some â Nektar is expected to deliver progress in the second half of 2013 in various proprietary and partnered programs, highlighting the depth and breadth of its platform technologies. In Q3, partner AstraZeneca is expected to file[…]

H2 OUTLOOK CNDO, OGXI, SGMO

H2 OUTLOOK CNDO, OGXI, SGMO: MTSL Stock of the Year Recommendation Coronado BioSciences has pulled back from an intraday high of $12.70 (on 4/23) to $7.55. The stock is still up 67% YTD, however the pullback from the high is no doubt a meaningful one…

Dune – Handicapping The Worm

DUNE â HANDICAPPING THE WORMSIGN CNDO â The Best and Worst Case Scenarios of TRUST I, Possible Stock Outcomes and Protection Strategies â Top-line results from the TRUST I clinical trial of Coronadoâs TSO in patients with Crohnâs disease (CD) will be released in the fourth quarter. Based upon the timing of the completion of[…]

ISIS & ASCO

ISIS & ASCO APO & CRP: Blockbuster Alphabet Soup for ISIS? Among its broad and deep R&D pipeline, ISIS has two potential home run compounds with important Phase II clinical data due by mid-year â each addressing multiple blockbuster drug markets. In our view, a successful result from either candidate is likely to establish ISISâ[…]

INCY Knows JAK

INCY Knows JAK Incyte Pharmaceuticals (INCY) is an MTSL recommendation and one of the few stocks that trades below its BUY LIMIT. In our February 15 update (Issue #748), we suggested that the Q4:12 quarterly report was a pivotal turning point for the company; and the stock subsequently had begun to make its move and[…]

PLENTIFUL PLATFORMS

PLENTIFUL PLATFORMS Several of the MTSL Portfolio Companies have business models based on proprietary platform technologies. Platform technologies are attractive for several reasons. Among the favorable investment characteristics, platforms provide the following: â¢Cutting edge technology â¢Multiple compounds, partners, therapeutic classes â¢Significant diversification/relatively lower risk â¢Initial drug candidates may be partnered earlier in development â¢Begins to[…]

ORPHANS FIND A HOME

ORPHANS FIND A HOME Orphan drugs (OD) have been a part of the biotech industry almost from its inception. The pioneer in Orphan Drug development is Genzyme, which was acquired by Sanofi last year to take advantage of the OD business model. Orphan Drugs resulted from the Orphan Drug Act (ODA) of 1983. (Think of[…]

BIOTECH RISK MANAGEMENT – AN OXYMORON?

Biotech Risk Management – An Oxymoron? With the vast majority of companies in the development stage and/or whose success is dependent on one key drug, biotechnology stocks are inherently quite volatile. Although the sector’s sizable rewards have been well documented of late, the outsized risks frankly never disappear. With many stocks trading at 52-week and/or[…]

BEST IN CLASS OR BUY THE CLASS

March 1, 2013 BEST IN CLASS OR BUY THE CLASS II After the last MTSL Issue (#748) titled âThe New Hot Classesâ â âsuper pillsâ for hepatitis C, and small molecule inhibitors of the novel targets BTK, Pi3K, JAK and PCSK9 â the ideal sequel to that subject is âBest In Class or Buy The[…]

GLORY DAYS

February 1, 2013 GLORY DAYS The performance of biotechnology stocks since the start of 2013 has been no less than stellar. The BTK and NBI are up 9% and 8% respectively, and the MTSL Model (+21%) and Traderâs Portfolios (+37%) are up sharply as well (see below).  Two of BioInvestâs recommended stocks â CNDO (+63%)[…]