February 20, 2013

PCYC – Understanding The New CLL Label & Introducing The Autoimmune Program – Raising BUY LIMIT and TARGET PRICE – A deeper dive into the recently-granted CLL label for Imbruvica reveals a much broader indication than the expected relapsed/refractory (R/R CLL) population.  As a result, in our view, time to peak sales is likely to occur sooner than consensus forecasts. End-user Q4 sales reported yesterday of $13.6 million ($3.6 million inventory) were much better than any forecast, but are only the beginning of the blockbuster path Imbruvica is on. Moreover, after an exhaustive look back at BTK inhibition in autoimmune disorders and ibrutinib in particular, we believe the new BTK compound that PCYC is about to put into human clinical studies will begin to slowly be factored into consensus models. With the Company about to address additional blockbuster markets as safe and effective orals again take share from the multi-billion dollar anti-TNF inhibitors, applying just a small likelihood of success for autoimmune (~5%) still has a meaningful impact on long-term valuation. Unlike ibrutinib in oncology, PCYC owns full global rights to BTK inhibitors for autoimmune disorders and the patent for the new compound expires in 2035.  Taken together, we are raising our BUY LIMIT and PRICE TARGET.

Imbruvica CLL Label – “After One Prior Therapy†– The initial response to the recent CLL approval for Imbruvica was that the FDA granted the drug a label expansion for relapsed/refractory CLL. Logic was that a) since the company filed for approval in R/R CLL (see 7/10/13 press release); b) was granted Breakthrough Therapy Designation for del p17 subset of CLL; and c) received FDA approval in November for R/R mantle cell lymphoma, the FDA would allow the larger CLL indication only in a refractory/relapsed setting – if at all. Since Phase III randomized trials were yet to be completed, let alone filed with the agency, a R/R CLL label was still a monumental accomplishment in unprecedented time.

However, last Tuesday the company received “accelerated approval†for Imbruvica for “previously treated patients who have received at least one prior therapy.†On the surface, this looks like a typical “R/R†label. However, according to the indication, patients need only to be treated with “one prior therapy†to be eligible for Imbruvica. For example, many newly-diagnosed patients are put on Rituxan single-agent despite the fact that it is not approved for front-line CLL on its own. (This is one reason, among others, why GILD is attempting to gain approval for idelalisib in combination with Rituxan – versus idelalisib as a single agent.) In fact, CLL patients initially put on Rituxan will qualify for adding Imbruvica after only the first Rituxan infusion. The same patient does not need to have relapsed or become refractory to Rituxan – they can simply add Imbruvica to their treatment regimen. The combination of I + R has shown meaningful synergy and increased quality of life in almost all patients versus less than half on Rituxan alone (http://www.mdanderson.org/newsroom/news-releases/2013/ibrutinib-and-rituximab-trigger.html). Both savvy doctors and CLL patients will now have an easy “back door†entry into Imbruvica treatment regardless of being front-line or refractory as all they need to quality for both Imbruvica treatment, and importantly reimbursement, is one prior therapy.

The FDA’s accelerated approval program allows for rapid commercialization of novel therapies that are dependent upon the future completion of successful randomized trials. Hence, the top-line RESONATE data, we believe, sealed the deal for the breadth of the label given last week. The FDA used the most conservative data in the new label (e.g., 58% response rate), likely acknowledging the generous label despite no available formal Phase III trial. (Remember, Roche’s Gazyva was just approved for CLL with a major registration study – hence, protocol.) Nonetheless, in a recent JMP Securities conference call, Dr. Steven Coutre of Stanford University (2/18/14), told us that all patients respond well to Imbruvica with an initial nodal response – even if they have stable disease – and that more like 98% benefit (vs the 58% response in the label). Dr. Coutre said that based upon all the trials underway, Imbruvica’s label will eventually cover “every CLL patient.â€

As a result of the broad new label, we expect consensus forecasts, currently around $225 million for 2014, will continue to be widely exceeded. In addition, now that PCYC can cover an even larger CLL population, rapid penetration will ensure that Imbruvica will become the standard of care sooner and for years to come. With a U.S. patent expiration of 2029, another 15 years of growth remains. This growth will further be entrenched by label expansion in combinations for DLBCL, FL, iNHL and, possibly what is still not in any models, multiple myeloma. By the time any real competition comes around (e.g., ABT-199, CART), Imbruvica will be years ahead. Its simple administration, durability of response (still not yet met) and, most important, safety profile will make it the Best-In-Class for a very long time.

Its About To Begin – An Optimized PCYC BTK Inhibitor For Autoimmune Disorders – Over the past 3-4 years, PCYC’s research group has been quietly optimizing a new BTK compound specifically for autoimmune disorders (e.g., RA, SLE, Type 1, IBD, Crohn’s, etc.). An early-stage compound was dropped in the preclinical setting back in 2011 due to an off-target side effect (i.e., not due to efficacy or BTK inhibition). With the incredible CLL data, ibrutinib’s speedy path to commercialization gave Pharmacyclics the luxury of not rushing to develop a sub-optimal compound. For every reason, the value of PCYC is entirely based upon Imbruvica. In January, however, the company filed an IND and received the approval to begin studies for a novel BTK inhibitor for autoimmune disorders. After an exhaustive review of the available literature, in our view, this new compound will begin the next chapter of Pharmacyclics – one with as much and/or even greater potential as Imbruvica in oncology.

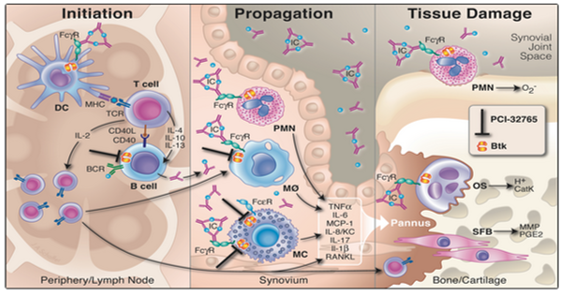

Role of BTK in AutoImmune. There are various published studies discussing the role of BTK and BTK inhibition in autoimmune disorders. In fact, several preclinical studies exist describing ibrutinib’s potential role in autoimmune conditions. One of the more telling articles was published in the PNAS (www.pnas.org) where, in a murine model of arthritis, oral administration of ibrutinib resulted in a “marked inhibition of clinical arthritis scores seen in mice treated at all doses. A partial and a nearly complete elimination of clinical signs of disease occurred after 9 to 11 days of treatment at dosages of 3.125 and 12.5 mg/kg per day, respectively.†In another paper in Arthritis Research & Therapy (arthritis-research.com), PCYC research head Betty Chang published a study showing ibrutinib “potently and dose dependently reversed clinical arthritis and prevented cartilage and bone erosion in an aggressive late-stage CIA model, and in a CAIA model.â€Â The illustration below shows the mechanism of action of BTK and ibrutinib and its effect in the periphery/lymph node, synovium and bone/cartilage. (With Rituxan’s approval to treat rheumatoid arthritis and with positive data in multiple sclerosis, blocking the B-cell pathway for autoimmune disorders has been well established.)

Why Not Use Ibrutinib For RA? If ibrutinib is so useful in arthritis, a logical question is: why didn’t or hasn’t PCYC gone that route? The answer is simple. The resounding CLL data allowed for the fastest route to market and the greatest pricing power of what is now Imbruvica. In addition, there are some side effects that are perfectly acceptable in treating cancer patients that may not be ideal for a non-life threatening illness like arthritis. The literature shows that the B-cell inhibition dose required to dampen an autoimmune response maybe as little as 1/10 of what is required to treat CLL. A lower dose also has the potential to lessen the potential for side-effects. Hence, a highly optimized version of ibrutinib – and an entirely new molecule – makes sense. Lastly, pricing of a new RA pill needs to be significantly lower than one can charge for oncology. (Remember that Genentech’s Avastin works extremely well in wet AMD but costs less than 10% of Lucentis). In addition, over the past four years, PCYC has been able to observe the clinical results of new targeted therapies for arthritis, understanding the most desirable advantages and competitive shortcomings.

The Shift To New Orals For AutoImmune Is Among Us. The major advantage provided by the new targeted compounds are that they are pills with efficacy equal to or better than that of the shots (please see MTSL Issue #745 “ORAL ARGUMENTS,†1/4/13). In various illnesses – certain cancers, antiviral and autoimmune disorders – dominated by injectable/infused drugs, the shift to the “super pills†by the New Classes is well underway (e.g., Solvadi, Tecfidera, Imbruvica, Xeljanz, etc.). BIIB’s Tecfidera is the best new example of autoimmune pills, and with the upcoming approval of CELG’s Otezla (apremilast), another shift away from the injectable anti-TNF inhibitors, a $20+ billion market, will begin. An excellent review article published last October entitled, “Novel Small Molecule Therapeutics in Rheumatoid Arthritis†by Stanford University’s Victoria Kelly, Mark Genovese (Rheumatology. 2013;52(7):1155-1162. www.medscape.com) provides an extremely helpful overview of the key new targets – including Janus-associated kinase (JAK-STATs), spleen tyrosine kinase (SYK), phosphodiesterase-4 (PDE-4), Bruton’s tyrosine kinase (BTK). Compounds that have made it to market include PFE Xeljanz, the first but a dirty pan-JAK inhibitor with underwhelming sales to date. CELG’s Otezla – the first PDE-4 inhibitor, is highly likely to be approved by March for psoriatic arthritis. INCY’s baricitinib (partnered with Lilly) will release Phase III RA data this year, which in our view, will be better than Xeljanz due to bari’s better specificity (selectively targets JAK 1&2). Galapoago’s GLPC0634 (JAK1) is in trials for RA and Crohn’s disease. SYK inhibitors have disappointed with RIGL’s fostamatinib and Portola’s SYK inhibitor program (licensed to BIIB), although GILD is developing GS-9973 in oncology. INFI has IPI-145 (a Pi3K inhibitor) in studies with severe RA and asthma and initial data is due this year. And for BTK, CELG entered the clinic last year with CC-292 in RA and initial data may be available later this year.

PCYC Retained Full Rights to BTK AutoImmune Program – Way back in 2011, when CEO Duggan formed the then unprecedented JNJ collaboration, the early CLL data allowed him to forge one of the greatest collaborations to realize significant value out of a Phase II drug (and remain independent) in the history of biotechnology. In addition to full U.S. control of ibrutinib’s clinical and commercialization paths, almost $1 billion in guaranteed, non-dilutive cash and zero equity, one of the least remembered terms of the deal was that PCYC retained full worldwide rights to BTK inhibitors for autoimmune disease (including ibrutinib). This last item may end up being the most rewarding of all. With a 20-year patent life on the new compound (expiration 2035), the leverage to Pharmacyclics of a successful autoimmune drug is extraordinary.

What Do We Know About PCYC’s AutoImmune Program? We know that:

- a.B-cells and BTK play a meaningful role in autoimmune disorders

- Ibrutinib preclinical data in an RA mouse model is exceptional

- Initial clinical trial results may be available by the end of 2014

- The market for a safe and effective new targeted RA pill is substantial

- PCYC owns 100% of the BTK autoimmune program

- The patent on the new compound expires in 2035

- PCYC for autoimmune is given zero value by investors

- We expect that to change this year

Raising BUY LIMIT and TARGET PRICE. Based upon the above analysis, we believe Imbruvica will reach peak sales sooner and last longer than current consensus forecasts. While we may be a bit early on the autoimmune program, it will certainly become a regular part of the conversation beginning with the Q4 quarterly earnings call. Over time, we believe the combination of Imbruvica and the new BTK inhibitor for autoimmune diseases will propel PCYC shares into the realms of the REGN and ALXN market capitalizations.