MTSL Issue 992

IN THIS ISSUE: With So Many Biotech Companies, Stock Selection Is Key

Since Last Issue: BTK: -0.05%; NBI: -0.94%; XBI: 2.50%; Model Portfolio: 26.16%

SENTIMENT — Stuck In The Healthy Range Of So-So

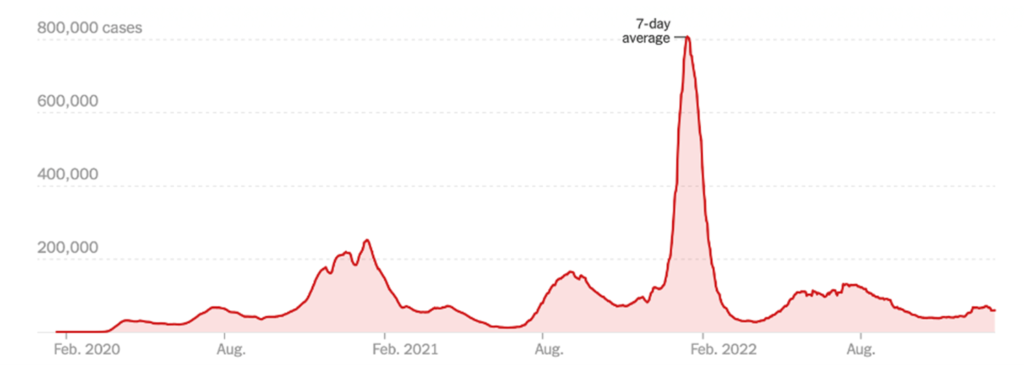

COVID News — It’s Bad Again — COVID Is Rising But With Home Tests, The Reported Numbers Are Too Low; China Is Exploding; the Omicron subvariant XBB.1.5 emerges and the weather stinks!

It’s Worse Than The Numbers Show – The Tridemic Is On…And Under-reported

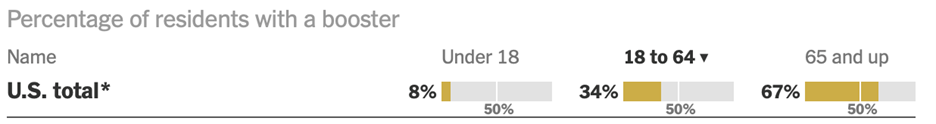

While most national data has been fairly flat in recent days, test positivity is rising sharply. This suggests that there are far more new cases circulating than what official reports show. Moreover, the Omicron subvariant XBB.1.5 has emerged of late. It now makes up nearly 41% of nationwide COVID cases and is responsible for 75% of the cases in the Northeast. Cases and hospitalizations may both increase next week when more regular reporting patterns resume as the Holiday season ends. The latest data shows an 11% drop in positive cases over the past two weeks, but it’s really difficult to believe things are getting any better, in particular as flights and football game are packed around the world. In addition, with home tests and mild symptoms, the actual numbers are probably significantly higher. Positive tests, on the other hand, are up 23% over the same period and those are the more seriously ill patients. Hence, the 8-11% rise in hospitalizations and I.C.U. patients. The ROW cases have followed the U.S. rates, with hot spots in Japan, Europe and Australia. As the exhibit below shows, only about a third of Americans aged 18-64 have received a COVID booster. Assuming the majority of vaccinated received their shots in 2020-2021, most people are walking around unprotected and without masks.

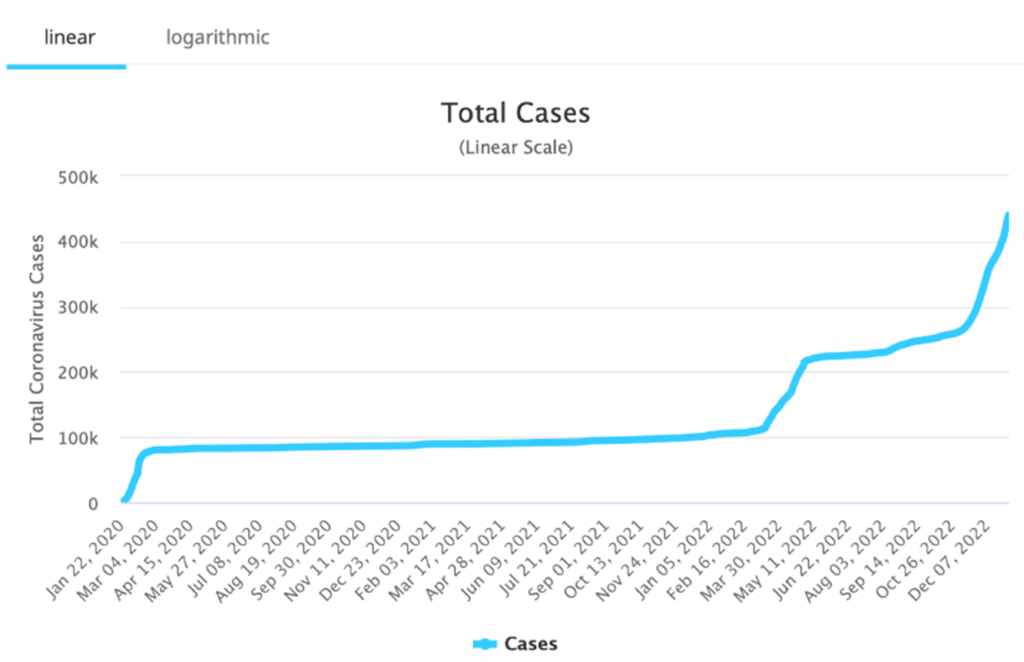

How Big Is China’s Outbreak?

It’s almost impossible to call the actual amount of positive cases in China. The latest Worldometer report says the total number of cases are heading towards half a million, although that sounds way too low. A leading physician in China recently commented that he believed the contagion rate in Shanghai (25 million people) was as high as 70%. With relatively poor vaccine quality, and overcrowded hospitals, it is very hard to know what the global impact will be as the country has basically abandoned its “zero-COVID” policy due to overwhelming national protests. Some countries, including the U.S. and Britain, have reintroduced required testing pre-flight for anyone departing China. Others nations, including Japan and Italy, are only requiring testing upon arrival and quarantine for any COVID-positive travelers.

Total COVID Cases In China?

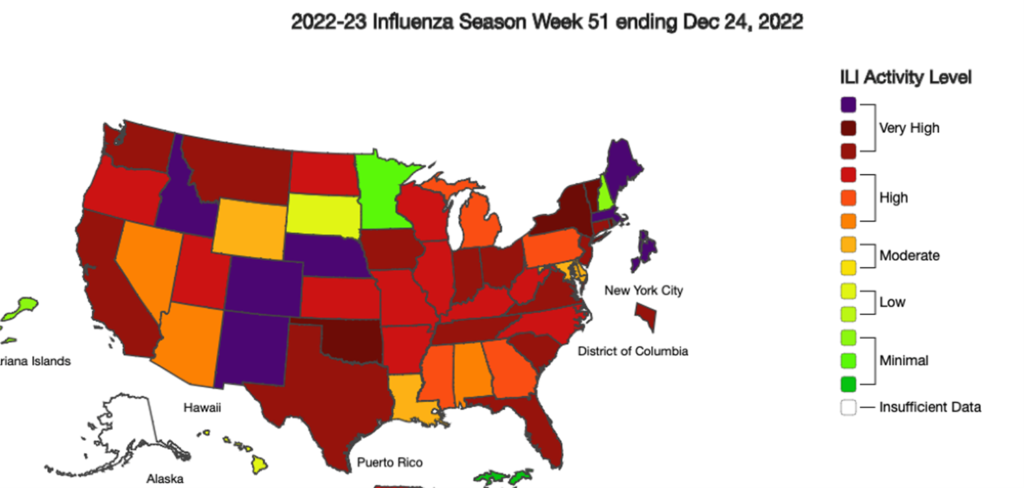

Flu Still Very High

Flu cases remain in the “very high” range across the country, although it has begun to ease up a little in some regions. Nonetheless, the Tripledemic (COVID, flu, RSV) is still in the intense stages, with pressure on hospital staffing still high. The pace is expected to pick up, as kids go back to school. So its not too early to get a flu vaccine.

SENTIMENT – Will lecanemab’s Approval & JPM Bring Some Relief?

While the biotech sector ended 2023 with a flurry of positive clinical, regulatory and M&A activity, sustained high interest rates and too many biotech companies kept a lid on the indexes. One might think that with all the good news (including a much less onerous Medicare drug pricing policy than thought) that biotech stocks would fare better. Most of the good news on the IRA bill went to the Big Pharma/Big Bios – where the IBB and DRG indices – outperformed from September to December. On the other hand, the XBI has been treading water over the same period. Why is that? There are just too many companies. On a plus note, BIIB’s Alzheimer’s drug received approval and the major JPMorgan Healthcare Conference begins this week.

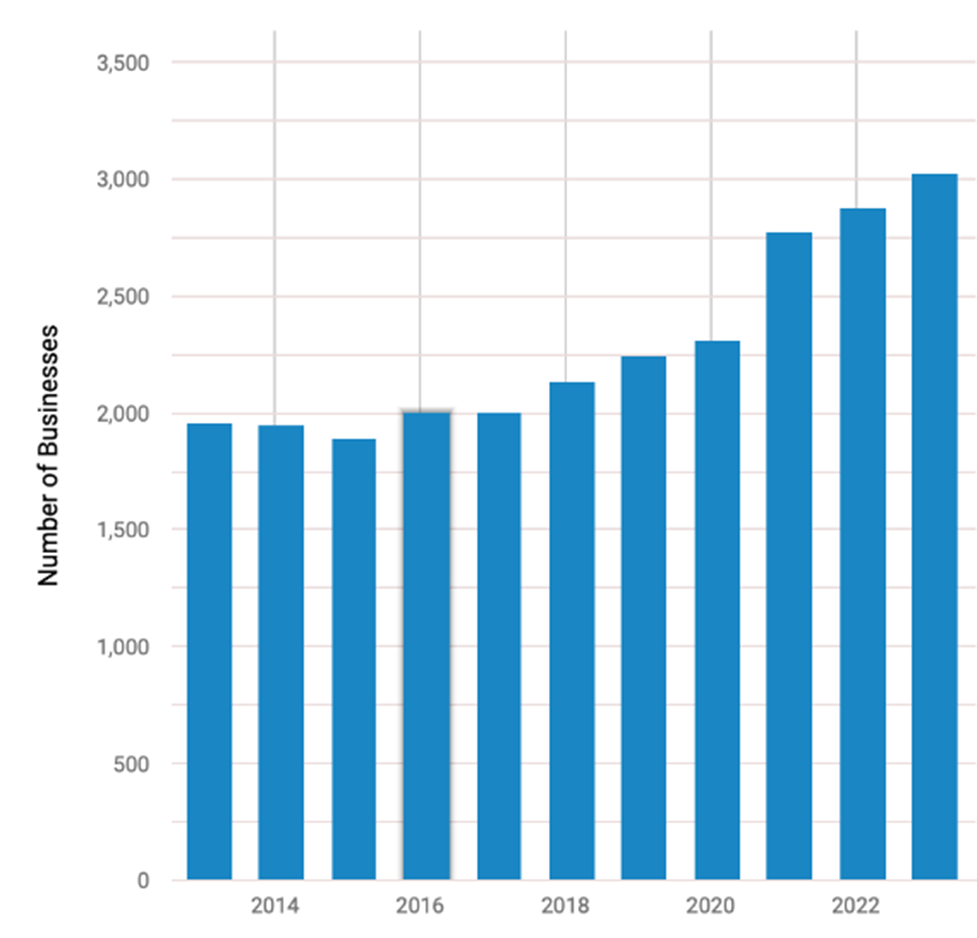

And that is why stock picking is so crucial in the sector, and the only thing that will really lead to outsized returns. The chart below shows that from 2013-2018, the number of biotech companies around was roughly 2,000. With the major success of a handful (we believe that the ABBV takeover of MTSL Recommendation PCYC was a key trigger for the explosion in the group), that number has grown by at least 50% since to over 3,000 (and more overseas). Hence, it so important to pick the right stocks and while we will not be able to find every winning company, MTSL has been successfully finding the needles in the haystacks for decades. Since the last Issue, Madrigal (MDGL) – one of our favorites since 2017 – delivered the most successful Phase III NASH results ever – and its stock more than tripled last year.

Number of U.S. Biotech Companies

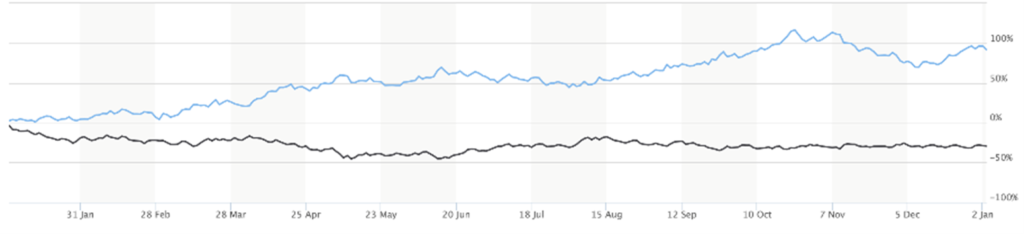

30-Year Bond Yield vs. XBI

Fighting The Fed Is Still Impossible

With the plethora of new biotech Issues coupled with the historic rise in interest rates, risky biotechs as a whole continue to struggle. The 30-year bond yield closed at 3.56%, down from a peak of around 4.25% at early November. The gap between the 30-year Treasury bond yield and the XBI has narrowed as the XBI acts relatively better but many bios are still undergoing some year-end tax loss selling. And again, while there has been a lot of good biotech news, the sector has had to deal with stabilizing rates versus individual stock tax-loss selling. As the 30 year has meaningfully come off the peak, the XBI has basically stayed flat (in the 75-85 trading range); hence, relative outperformance but absolute flattish behavior. Around press time, the Fed reiterated it’s hawkish stance (it has to keep the pressure on) and the December job report added more fuel to it’s position. Higher rates bode poorly for biotech stocks, while a peak/change in the Fed stance (not expected in the near-term) would trigger some optimism. Inflation data, on the other hand, is proof that price gains have peaked in many areas. Its just still way above the Fed target. Hints of peak rates and the halting of interest rate hikes will continue throughout the year.

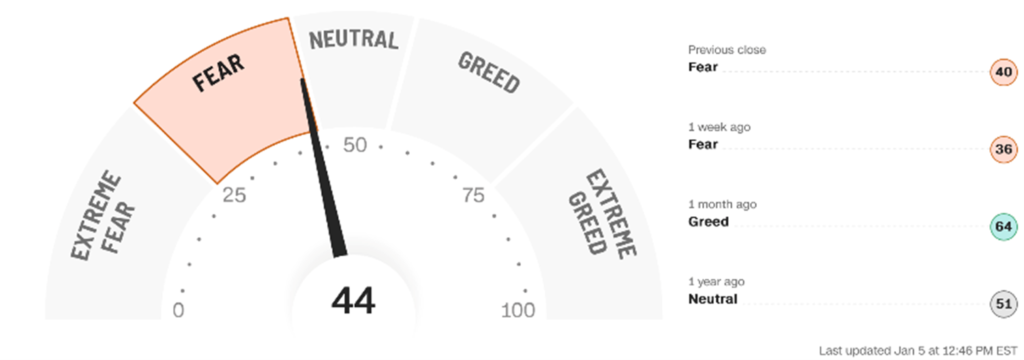

Fear & Greed Index

F&G Index Back To FEAR/NEUTRAL

The Fear & Greed index (44) closed in the FEAR zone, down from 50 and in the NEUTRAL area of the last Issue. The economic slowdown is becoming more evident than ever, but China’s impact on previous leaders AAPL and TSLA is having the opposite impact compared to its COVID 2021-2022 support. “Soft landing” dialogue has turned into how deep a recession will it be with real estate/oil and the rest of the world now slowing along with the U.S. Awful weather globally isn’t helping either. Frankly, it is a rather healthy winners and losers environment with a chunk of cash still on the sidelines. Leading Blue Chips stocks like BA and RTX act great, while the tech stocks continue to flounder and many hit new 52-week lows. MTSL stocks MDGL, CLDX and MYOV all ended 2022 at 52-week or all-time highs. Again, you need to pick the right stocks (if you haven’t yet, please subscribe today https://bioinvest.com/subscribe/). Consumer debt, higher costs of living and weak stocks are more than absorbing the majority of discretionary income left over from the pandemic and/or decent pay raises. There is a lot of data suggesting that when stocks have as bad a year as in 2022, then the next year results in strong rebound performances. One needs to remember, however, that a 30% drop in a stock needs a 43% rebound just to break even. When the F&G Index is in FEAR (or EXTREME FEAR better yet), that is usually a good time to add to stock exposure. But nothing beats picking the right stocks!

lecanemab Approval Another BioPharmaceutical Success For A Previously Untreated Major Chronic Illness

This past Friday (January 6) Biogen/Esai received FDA approval for lecanemab, the first truly effective drug proven to slow the progression of Alzheimer’s disease. While not a cure, the drug is a major advance in the field. And as we have said so many times before, this compound is a monoclonal antibody – one of the classic successes of biotech. According to ICER, the beta amyloid-directed monoclonal antibody must be priced lower than $20,600 a year to be cost-effective. Specifically, ICER’s calculations suggest that the Alzheimer’s Disease drug’s demonstrated benefits in a Phase 3 trial — a modest but statistically significant slowing of cognitive decline — are valued at between $8,500 and $20,600 per year. Formal FDA approval is wonderful news for both patients and biotech and starts 2023 off with important positive news.

JPM Conference Usually Brings A Rally & Some Good News

The annual JPMorgan Healthcare Conference takes place this week in San Francisco (https://www.jpmorgan.com/solutions/cib/insights/health-care-conference). If it ever stops raining (ugh!), thousands of companies, investors and (of course) investment bankers will congregate and present new corporate updates (and have dinners and cocktail parties, etc.). In this conference, the first real in-person one in the post-COVID world since 2019, companies often release positive news – whether a corporate partner, 2023 outlooks and even some clinical trial results. The XBI often trades up in advance – which is has attempted to this week – and sometimes stays elevated, offen until the week and meeting subsides. Based on a number of variables – sometimes it just might be money coming back to work, an unexpected clinical trial win and/or premium takeover, the post JPM move almost always dictates the mood/sentiment for the rest of the year. The beginning of 2022 started off with a selloff that really never gave up from January-June, but since then saw some reprieve driven by many positive fundamentals and a decent handful of isolated winners. Many of our MTSL recommended companies will be at the meeting or surrounding ones run by by others (e.g. Biotech Showcase is a big one we like for many small firms – https://informaconnect.com/biotech-showcase/).

TECHNICALS – XBI Smack Dab In Trading Range But Above Moving Averages

The XBI (82) is still in the middle of its now two month trading range (75 – 85). The index remains in neutral zone with the RSI at 51 and a just drop up from the last Issue (48) three weeks ago. The sector is trying to rally ahead of the JPMorgan conference, but the macro headwinds are just too strong. Tax loss selling is behind us so some of those beaten down names are seeing some relief. (It’s not surprising when some stock is up over 100% these days – but its often the crestfallen names trading below $1.) On the other hand, some of the winners of 2022 are experiencing profit-taking (yes, profit taking) to assume the tax burden in 2024. On a plus note, the XBI is trading above both the 50- and 200-day moving averages – albeit barely. We will need a little more confirmation before declaring an improved technical situation. It will be interesting to see if the M&A wave that hit in Q4:22 continues, as premium takeovers always help in several ways.

On the weekly chart, the XBI is slowly trying to move upwards and stay above the 50-week MA resistance level (82). It remains neutral (RSI 49) and well below the longer-term 200-week index (103), but a move from 82 to 103 would be more than welcome. We need a lot more good news for that to happen – and most definitely need some macro help as well. Biotechs will do well in a recession. For now, we’ll take holding the 80-82 support on the XBI and see what the windfall of news coming out of this week’s investor soiree in San Francisco will bring. Individual stock picking is everything.

We wish all a Happy and Healthy and Peaceful 2023!!

MTSL Events Due Near-Term

With the stellar Madrigal Phase III resmetirom data released since the last Issue, our MTSL Universe (www.bioinvest.com) continues to deliver positive clinical data. We expect more in 2023:

PGEN – January 24 – Precigen to Host a Virtual R&D Event on January 24th to Share Safety and Efficacy Data from the Phase 1 Dose Escalation and Expansion Cohorts of PRGN-2012 AdenoVerse™ Immunotherapy in Recurrent Respiratory Papillomatosis

CLDX – February 24-27 – AAAAI Meeting (https://annualmeeting.aaaai.org/, San Antonio, TX) – further updates and data on barzolvolimab from several urticaria trials

ESPR – March 4 – ACC.23 (https://accscientificsession.acc.org/, New Orleans, LA) – CLEAR Outcomes Accepted as Late-Breaking Clinical Trial at ACC.23 Annual Scientific Session & Expo together with the World Congress of Cardiology (ACC.23/WCC)

MTSL Recommendations at 41st Annual J.P. Morgan Healthcare Conference:

- INCY 1/9 7:30AM PT

- BMRN 1/9 1:30PM PT

- PCRX 1/9 3PM PT

- IONS 1/11 9:45AM PT

- ESPR 1/11 1:30PM PT

- ALKS 1/11 11:15AM PT

- PGEN 1/11 3:45PM PT

In our Corporate Updates section below, we are including our write-ups for the Money Show 2023 list (https://www.moneyshow.com/) that will be released tomorrow morning (1/9). Our pick of Madrigal (MDGL) was the #1 Stock in the Money Show list out of the 118 Top Picks of 2022! We remain very bullish our current list of recommendations – in alphabetical order – ALKS, BMRN, CLDX, ESPR, INCY, IONS, MDGL, PGEN, SGMO, TCRT, VXRT.

Company Updates: Esperion (ESPR), Madrigal (MDGL)

ESPR — PCSK-9 MAbs Come Under Scrutiny – More Good News For Esperion As ACC23 Approaches – BUY

Independent international analysis suggests a higher cardiovascular mortality than previous published in Amgen’s Repatha CVOT study. Also, the Company’s CLEAR data has been accepted for the late-breaker presentation at the upcoming American College of Cardiology (ACC) Meeting in March.

BMJ Open Article Brings New Data

A strong warning has been issued for Amgen’s Repatha (evolocumab) by researchers from Spain and Canada for the use of the proprotein convertase subtilisin/kexin type 9 (PCSK9) inhibitor among adult patients who have established atherosclerotic cardiovascular disease following their analysis of purported inconsistencies between the FOURIER trial’s Clinical Study Report (CSR) and publication of primary trial results in 2017. A team of Restoring Invisible and Abandoned Trials (RIAT) investigators was formed for the new review of the FOURIER data in 2018. This team then applied to the European Medicines Agency (EMA), Health Canada, and the FDA for the FOURIER trial’s CSR. Access was granted only by the first 2 agencies, with the FDA noting in October 2019 that it could take up to 7 years to release the CSR, according to a BMJ Open article (https://bmjopen.bmj.com/content/12/12/e060172). Published just last week, the international team from Navarre Health Service, Navarre Institute for Health Research, and The University of British Columbia aim “to restore the trial’s mortality data based on the information contained in the death narratives in the CSR.”

The new review of the data comes to the following conclusion: “After re-adjudication, deaths of cardiac origin were numerically higher in the evolocumab group than in the placebo group in the FOURIER trial, suggesting possible cardiac harm. When the trial was terminated early, a non-significantly higher risk of cardiovascular mortality was observed with evolocumab, which was numerically greater in our readjudication. A complete restoration of the FOURIER trial data is required. In the meantime, clinicians should be skeptical about prescribing evolocumab for patients with established atherosclerotic cardiovascular disease.”

BA’s CLEAR Advantages; ACC March 4

Esperion’s bempedoic acid (BA) has a novel mechanism of action (MOA) to lower LDL cholesterol. Importantly, BA is a prodrug that works upstream in the liver and avoids the biggest complication of statins – muscle pain and myalgia. Moreover, the drug’s is more affective at significantly lowering inflammation – in particular the compounds reduction in CRP is greater than statins and it also reduces blood sugar. The data shows that ESPR’s Nexletol is an excellent option for statin intolerant patients and maybe a safer one than PCSK-9 inhibitors – especially with the new news above. Esperion recently announced that The CLEAR Outcomes trial will kick off the Late-Breaking Clinical Trial sessions in the Great Hall in New Orleans and will stream live on the ACC.23/WCC virtual platform, commencing at 9:30 AM Central Time on March 4, 2023.

Since the CLEAR Outcome hit its primary and secondary endpoints, physician and patient interest has increased dramatically leading up to the ACC meeting in March. The official published data in a peer-reviewed journal will also have a major positive effect on sales. Having a CVOT label will lead to significantly higher sales and potential partners will offer attractive financial terms in what we believe could end up being a near-term bidding war.

MDGL — MAESTRO-NASH Takes a BOW! MDGL Phase III Hits Both Endpoints in Fibrosis Resolution & Fibrosis, MDGL is now a BUY under 300 (was 200) with a TARGET PRICE of 400 (was 275)

- In MAESTRO-NASH, a 52-week serial liver biopsy Phase 3 study in more than 950 patients, resmetirom achieved both primary endpoints and potentially clinically meaningful effects with both daily oral doses, 80 mg and 100 mg, relative to placebo

- NASH resolution (ballooning of 0, inflammation of 0-1) and ≥2-point NAS reduction with no worsening of fibrosis (p<0.0001 at both doses)

- Fibrosis improvement by at least one stage with no worsening of NAS (p=0.0002 and <0.0001 at 80 and 100 mg, respectively)

- Potentially clinically meaningful LDL-lowering, a key secondary endpoint (p<0.0001)

MDGL has pitched a “perfect game” with their pristine MAESTRO-NASH Phase III trial hitting both primary, FDA agreed upon endpoints. The FDA had agreed that even hitting one primary endpoint would lead to approval. They hit both. This is first ever positive Phase III trial for NASH is a watershed event for both NASH patients and MDGL. With two positive Phase III trials in the bank, MAESTRO-NASH & MAESTRO-NAFLD, resmetirom is poised to become a multi-billion dollar drug as a once-a-day pill to treat both NAFLD and all stages of NASH.

In our view, the drug is a true best-in-class compound with both outstanding safety and efficacy all in an easy to take daily pill. The Company is expect to file for FDA approval in early H2:23. We expect a premium buyout for the company given resmetirom being both wholly-owned and completely de-risked. With this pristine data, we continue to recommend buying MDGL even at this new level. Other stocks with best-in-class drugs that we recommend include CLDX and ESPR.

Clinical Trials Watch

2023 Top Picks

Each year for the last 39 years, the MoneyShow.com has surveyed the nation’s most respected, time-tested market experts and newsletter editors for their favorite investment ideas for the coming 12 months. Those picks run the gamut from conservative, quality blue chips for safe and steady returns to high-growth stocks with massive potential upside. Our Top Pick for Madrigal was the #1 performer out of the 120 picks in last year’s report, with its year-end 2022 gain of roughly 200%.

TCRT — TCRT Poised To Become Leader in CAR-T Therapy For Solid Tumors

Alaunos TCRT is a true next generation CAR-T cell therapy company focused on treating solid tumors. The technology incorporates T-cell receptor (TCR) therapies based on its proprietary, non-viral Sleeping Beauty gene transfer technology and its TCR library targeting shared tumor-specific hotspot mutations in key oncogenic genes including KRAS, TP53 and EGFR which are prevalent in solid tumors. Sleeping beauty is a proprietary non-viral delivery system that allows for repeat dosing and improved manufacturing efficiencies compared to using viruses for cell therapy. The Company has a clinical and strategic collaboration with the National Cancer Institute and one of the world’s leading immune oncologist, Dr. Steven Rosenberg. To date, TCRT is the only public company to have successfully dosed human solid tumor patients with CAR-T therapy demonstrating sustained POC with Patient #1 who had a partial response and at 24 weeks approximately 30% of all T-cells were TCR-T cells. CAR-T therapies for cancer have the potential to offer a potential “cure” for patients with success to date only being achieved in much easier to target liquid/blood tumors. CAR-T therapy for solid tumors is a huge unmet medical need, and in our view, TCRT is a leader in the cutting edge space.

The company continues to make progress on both the clinical and manufacturing fronts which should result in more patients being treated faster in 2023. In our view, proof-of-concept (POC) has been established with Patient #1 who had a partial response and at 24 weeks approximately 30% of all T-cells were TCR-T cells. We expect TCRT to increase patient enrollment in 2023 as they continue to improve the manufacturing process and widen their net to screen more eligible patients. In our view, TCRT is the leader in developing CAR-T treatments for solid tumors and POC has been established with Patient #1 who had a partial response and at 24 weeks approximately 30% of all T-cells were TCR-T cells. The company is poised to become the leader in delivering cutting edge CAR-T therapy for solid tumors in 2023.

ESPR — A CLEAR Differentiated Winner In Cardiovascular Disease

Esperion is a de-risked biotech company in the cardiovascular sector with its lead drug, bempedoic acid (BA) — branded NEXLETOL — already FDA approved to reduce LDL cholesterol. It is a safe and effective alternative to statins and reduces LDL in patients on its own and in those that are statin-intolerant, an enormous market that comprise about 10% of all statin-eligible patients (roughly 20 million people worldwide). In December, ESPR delivered positive, statistically significant top-line clinical data (at least a 15% improvement in MACE-4) from it’s flagship Phase IV study — Cholesterol Lowering via Bempedoic acid, an ACL-Inhibiting Regimen — the CLEAR Outcomes trial. The Company announced that the trial met its primary endpoint, demonstrating statistically significant risk reduction in MACE-4 (Major Averse Cardiovascular Events) in patients treated with 180 mg/day NEXLETOL compared to placebo. The Company will file for an expanded FDA shortly that will lead to a greatly expanded label (plus widespread insurance coverage) to include these great lifesaving results. Importantly, the CLEAR comprehensive trial data will be presented at the American College of Cardiology (ACC) Annual Scientific Sessions March 4, 2023.

CLEAR Cardiovascular Outcomes Trial CLEAR Outcomes is a Phase 3, event-driven, randomized, multicenter, double-blind, placebo-controlled trial designed to evaluate whether treatment with bempedoic acid (BA) reduces the risk of cardiovascular events (death, heart attack or stroke) in patients with or who are at high risk for cardiovascular disease with documented statin intolerance (inability to tolerate two or more statins, one at a low dose) and elevated LDL-cholesterol levels (fasting blood LDL-C ≥ 100 (2.6 mmol/L)). The study included over 14,000 patients at over 1,200 sites in 32 countries.

The CLEAT CVOT trial positive results are a watershed de-risking event for ESPR. ACC in March will be a very important meeting as the company now has a very attractive de-risked drug/drug combo that provides a significant LDL lowering/death benefit that is a wholly owned asset that is un-partnered in the U.S. Having a CVOT label will lead to significantly higher sales potentials and potential partners can either offer attractive royalties or just buy the company out right in what we believe could end up being a near-term bidding war.

MDGL — MAESTRO-NASH & MAESTRO-NAFLD Both Positive in 2022; Take a BOW! HOW ABOUT A BUYOUT FOR AN ENCORE IN 2023?

MDGL has pitched a “perfect game” with their pristine MAESTRO-NASH Phase III trial for resmetirom hitting both primary, FDA agreed upon endpoints. The FDA had agreed that even hitting one primary endpoint would lead to approval. They hit both. This is first ever positive Phase III trial for NASH and is a watershed event for both NASH patients and MDGL. The company also had great Phase III MAESTRO-NAFLD data for resmetirom in early 2022. With two positive Phase III trials in the bank, MAESTRO-NASH & MAESTRO-NAFLD, resmetirom is poised to become a multi-billion dollar drug as a once-a-day pill to treat both NAFLD and all stages of NASH. In our view, the drug is a true best-in-class compound with both outstanding safety and efficacy all in an easy to take daily pill. The Company is expected to file for FDA approval in early H2:23.

We expect a premium buyout for the company given that resmetirom is both wholly-owned and completely de-risked.

There are two additional reasons that MDGL will be acquired; the Baker Bros who are major stock owners and just saw another of their stocks, Horizon acquired in a bidding war by Amgen. With this pristine data from two Phase III trials, MAESTRO-NASH & MAESTRO-NAFLD, we continue to recommend buying MDGL even at this new level. Other stocks with best-in-class drugs that we recommend include CLDX and ESPR.

PGEN — Four Novel Compounds With Revolutionary ULTRA-CAR-T Technology – Precigen is a novel biotech company with a broad R&D pipeline focused on immuno-oncolgoy, autoimmune and infectious diseases

The Company’s ULTRA-CAR-T technology has the advantages of non-viral multi-gene delivery, overnight manufacturing process, higher antigen-specific expansion and in vivo persistence, with an integrated kill switch. The lead compounds under development are all in clinical trials with positive data recently and/or about to be presented in 2023.

PRGN-3006 – Recent data was presented at ASH (December) for PRGN-3006 UltraCAR-T® in acute myeloid leukemia (AML); In late-stage, terminal patients, there was a 27% objective response rate with patients receiving one dose in an ongoing Phase 1b study. Dose expansion is underway at the Mayo Clinic in Rochester, Minnesota, with multicenter expansion and technology transfer and site activation activities underway at multiple new centers.

PRGN-2012 – Enrollment is complete in Phase 1 study of PRGN-2012 AdenoVerseTM Immunotherapy in recurrent respiratory papillomatosis (RRP); the data will be presented in January 2023 and it is expected to show at least a 40% response rate in these patients. Recurrent respiratory papillomatosis (RRP) is a disease characterized by recurrent wart-like growths on the surface of the vocal cords or tissue around the vocal cords. A Phase 2 study has been initiated and is rapidly progressing. Most important, based on the positing upcoming results and the fact that there is no other treatment for these patients other than repeated surgeries (tens or hundreds per patient), we believe the Company will be able to gain an accelerated FDA path for PRGN-2012.

PRGN-3005–Enrollment is complete in the Phase I trial of PRGN-3005 UltraCAR-T in advanced ovarian cancer; enrollment complete at Dose Level 3 with lymphodepletion in the IV arm; early data from the initial very late-stage patients, objective responses have been observed. PRGN-3005 UltraCAR-T is manufactured using a decentralized, overnight manufacturing process and administered patients the next day.

PRGN-2009 – Enrollment complete in combination arm of Phase 1 study of PRGN-2009 AdenoVerse Immunotherapy in human papillomavirus (HPV)- associated cancers. PRGN-2009 leverages Precigen’s UltraVector® and AdenoVerse™ platforms to optimize HPV antigen design and delivery using a gorilla adenovector with a large payload capacity and the ability for repeat administration.

2023 will be a transformative year for Precigen with further clinical and corporate progress in the broad R&D pipeline. We believe encouraging data on any of the four programs above will lead to at least one large corporate partnership this year. Since it owns its technology outright, we also believe Precigen is an very attractive takeover candidate, in particular at the current, depressed market valuation.

The Back Page

| Symbol | Company | Orig.Rec. | Current | Target | Recommendation |

|---|---|---|---|---|---|

| ACAD | Acadia | 33.79 | 17.37 | 45 | BUY under $28 |

| ALKS | Alkermes | 10.13 | 26.35 | 55 | BUY under $35 |

| BCYC | Bicycle | 43.92 | 30.88 | 75 | BUY under $50 |

| BMRN | BioMarin | 12.68 | 108.17 | 150 | BUY under $100 |

| CLDX | Celldex | 10.50 | 42.97 | 85 | BUY under $55 |

| ESPR | Esperion | 24.42 | 6.30 | 25 | BUY under $10 |

| INCY | Incyte | 5.88 | 81.00 | 108 | BUY under $85 |

| IONS | Ionis | 7.63 | 40.40 | 65 | BUY under $50 |

| MDGL* | Madrigal | 17.00 | 272.19 | 400* | BUY under $300* |

| MYOV | Myovant | 13.74 | 26.89 | 45 | BUY under $30 |

| PCRX | Pacira | 15.78 | 38.62 | 100 | BUY under $80 |

| PGEN | Precigen | 34.42 | 1.59 | 24 | BUY under $12 |

| SGMO | Sangamo | 4.77 | 3.38 | 30 | BUY under $20 |

| TCRT | Alaunos | 8.00 | 0.71 | 12 | BUY under $5 |

| VXRT | Vaxart | 8.00 | 1.00 | 30 | BUY under $15 |

| ZYNE | Zynerba | 8.00 | 0.52 | 16 | BUY under $8 |

*New recommendation.

THE MODEL PORTFOLIO*

| COMPANY | SHARES OWNED | TOTAL COST | TODAY’S VALUE |

|---|---|---|---|

| Long Positions | |||

| Acadia | 4,750 | 156,557 | 82,508 |

| Alaunos | 26,125 | 166,100 | 18,549 |

| Alkermes | 3,800 | 88,690 | 100,130 |

| Bicycle | 2,400 | 105,408 | 74,112 |

| Celldex | 15,832 | 174,993 | 680,301 |

| Esperion | 3,316 | 105,316 | 20,891 |

| Incyte | 1,229 | 34,817 | 99,549 |

| Ionis | 3,087 | 49,123 | 124,715 |

| Madrigal | 3,127 | 69,980 | 851,138 |

| Myovant | 7,125 | 103,853 | 191,591 |

| Pacira | 2,375 | 63,887 | 91,723 |

| Precigen | 9,690 | 76,510 | 15,407 |

| Sangamo | 19,456 | 253,596 | 65,761 |

| Vaxart | 29,687 | 250,000 | 29,687 |

| Zynerba | 10,192 | 150,003 | 5,300 |

| (01/05/23) | Equities: | $2,451,362 | |

| Cash: | $41,619 | ||

| PORTFOLIO VALUE: | $2,492,980 |

*The Model Portfolio is designed to reflect specific recommendations. We began the Model Portfolio on 12/23/83 with $100,000. On 4/13/84, we became fully invested. All profits are reinvested. Stocks recommended since then may be equally attractive, but may not be in the Model Portfolio. Transactions and positions are valued at closing prices. No dividends are created, and we don’t use margin. Interest income is credited only on large cash balances.

The Model Portfolio

BENCHMARKS

| NASDAQ | S&P 500 | MODEL | |

|---|---|---|---|

| Last 3 Weeks | -4.3% | -1.9% | 26.2% |

| 2023 YTD | -1.0% | -0.4% | -3.0% |

| Calendar Year 2022 | -33.1% | -19.4% | 12.7% |

| Calendar Year 2021 | 21.3% | 26.9% | -15.2% |

| Calendar Year 2020 | 43.6% | 16.3% | 13.8% |

| Calendar Year 2019 | 35.2% | 28.8% | 10.7% |

| Calendar Year 2018 | 5.7% | 6.6% | 4.5% |

| Calendar Year 2017 | 29.3% | 19.9% | 65.6% |

| Calendar Year 2016 | 7.5% | 9.5% | -29.6% |

| Calendar Year 2015 | -0.1% | -0.1% | 25.1% |

| Calendar Year 2014 | 13.4% | 11.4% | 29.2% |

| Calendar Year 2013 | 38.3% | 29.6% | 103.4% |

BENCHMARKS

New Money Buys

NEW MONEY BUYS

Contact Info

Medical Technology Stock Letter

John McCamant, Editor

Jay Silverman, Editor

Jim McCamant, Editor-at-Large

BioInvest.com

579 Mangels Ave.

San Francisco, CA 94127

510-843-1857

Send us an email

Download a PDF of MTSL Issue #992

©Piedmont Venture Group (2023). Address: 579 Mangels Ave., San Francisco, CA 94127. Telephone: (510) 843-1857. Fax: (510) 843-0901. BioInvest.com. Email: admin@bioinvest.com. Published 24 times a year. Email subscription rates: 1 year – $399; 2 years – $678; 3 years – $898. You may cancel within 48 hours for a full refund. The information and opinions contained herein have been compiled or arrived at from sources believed to be reliable but no representations or warranty, express or implied, is made as to the accuracy or completeness. In no way shall this newsletter be construed as an offer to sell or solicitation of an offer to buy any securities. The publisher and its associates, directors or employees may have positions in, and may from time to time make purchases or sales of, securities mentioned herein. We cannot guarantee and you should not assume that future recommendations will equal the performance of past recommendations or be profitable.